|

| This man took twelve times the cost of the London Riots out of the economy and didn't pay a penny of tax . |

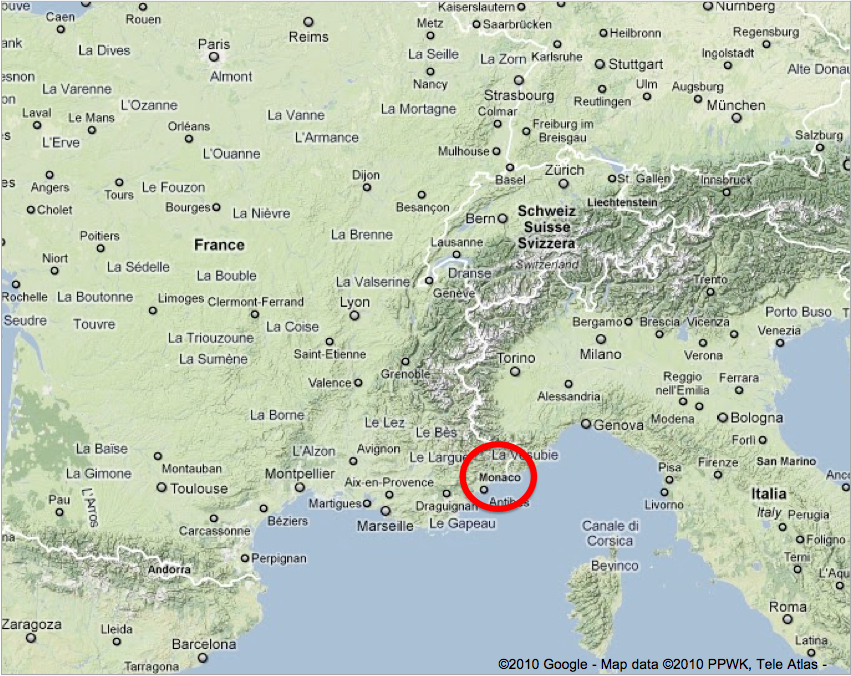

George Osbourne, David Cameron, Boris Johnson, the Financial Times and the country’s top 1% of earners are all telling us that the 50p tax rate for the country’s top earners should be removed else those same top earners will leave the country and move to Switzerland or Monaco. Tax Havens.

The top earners in this country are effectively holding the country to ransom despite the fact that these people have become the bane of our global economy. There is a near-global debt crisis which has severely damaged a very large number of economies and is threatening to push us back into recession, the stock markets have been incredibly shaky and many countries have been experiencing little growth.

Our government claims that the 50p tax rate is putting a strain on our economy and isn’t getting us all that much money so we might as well get rid of it.

But lets look at the rich poor divide, you may have noticed that with high levels of unemployment, weak growth, large cuts to public services and a rise in VAT that we are all a little bit less off... Well unless you’re in the top earners bracket, take the UK’s top 1000 earners who increased their wealth by 18% in the 2010-2011 financial year.

The problem is that we have suffered a 1929 style recession and are now in a depression, except that the world has not learned from the mistakes made back then. In the UK we are making heavy cuts in every sector, reducing consumer confidence, increasing unemployment and fuelling stagnation. In the US Obama has been attempting Keynesian economics, but has been largely thwarted by the Tea Party in doing so; with large scale projects failing to come to fruition despite billions of dollars being thrown at them meaning that the large construction and infrastructure projects are not happening.

The problem is that many countries have the same problem regarding tax havens, to the extent that this is an international scandal. Countries with 0% Income Tax have put such a strain on western economies that it’s become almost a crime against humanity. Take Monaco, for example, the “country” relies almost entirely on France for it’s existence to the extent that it’s railway it run completely by the French State-run railway operator SNCF, the country has a population smaller than Oldham and is only beaten to the title “smallest country in the world” by the Vatican. This country is instrumental in allowing Phillip Green to avoid paying taxes in the United Kingdom; in 2005 Phillip Green gave himself a £1.2 bn pay cheque when he declared a dividend payout in his company the Arcadia Group, this was technically paid to his wife who is officially a resident in Monaco meaning that he avoided £285 m of tax in a single payout.

|

| This tiny country with a population of 80,000 costs the UK economy billions every year, more than we spend on wars! |

So, a single British man in charge of a British Company who has earned all of his money in Britain, has been given grants by the British Government, been given security by the British Police Force, been educated by the British state education system, used roads and airports paid for by the British tax payer and has a vote in Britain avoided £285 m of tax, enough to build more than 10 brand new secondary schools, in one day whilst removing £1.2 bn from the British economy.

Let’s put that £285 m into perspective; the London riots will cost the tax payer around £100 m with several hundred if not thousands of people being punished severely for those actions with jail sentences left, right and centre. So a man who has deliberately avoided paying nearly three times that figure gets off free, and even gets to have personal chats with our Prime Minister and occasionally (okay only once so far!) gets brought in on certain jobs making our government “more efficient”. And he's one of the people telling us that the 50p tax rate is too high!

Naturally Phillip Green is only one man and punishing him would not solve this problem, if we are to solve the £120bn/year tax avoidance problem in this country we must look at the tax havens and find a way of solving this problem. It may well be necessary that the U.N. should be involved in the matter, or maybe the G8 needs to find a way to ensure that tax havens are not given an easy break any more.

However, more realistically, we need to look into our home affairs. If we remove the 50p tax rate now at a time when VAT is at 20% then this country will have given in to the elite it will have given them an even greater opportunity to suck more of this country’s wealth and to give them more power over us. This is crucial, if we allow the top 1% of earners to have more control over our money we are giving them more power, giving them more opportunities to demand X, Y and Z else they’ll “leave the country” else before long we’ll be saying good bye to far more than just our money.

Let’s put that £285 m into perspective; the London riots will cost the tax payer around £100 m with several hundred if not thousands of people being punished severely for those actions with jail sentences left, right and centre. So a man who has deliberately avoided paying nearly three times that figure gets off free, and even gets to have personal chats with our Prime Minister and occasionally (okay only once so far!) gets brought in on certain jobs making our government “more efficient”. And he's one of the people telling us that the 50p tax rate is too high!

Naturally Phillip Green is only one man and punishing him would not solve this problem, if we are to solve the £120bn/year tax avoidance problem in this country we must look at the tax havens and find a way of solving this problem. It may well be necessary that the U.N. should be involved in the matter, or maybe the G8 needs to find a way to ensure that tax havens are not given an easy break any more.

However, more realistically, we need to look into our home affairs. If we remove the 50p tax rate now at a time when VAT is at 20% then this country will have given in to the elite it will have given them an even greater opportunity to suck more of this country’s wealth and to give them more power over us. This is crucial, if we allow the top 1% of earners to have more control over our money we are giving them more power, giving them more opportunities to demand X, Y and Z else they’ll “leave the country” else before long we’ll be saying good bye to far more than just our money.

|

| In 2008 the Conservatives called the VAT tax break a bombshell, claiming the Labour government was going to increase it to 18.5% at a later time. The Conservatives and Liberal Democrats increased this to 20%. |

No comments:

Post a Comment